The House of People’s Representatives, the lower chamber of the Ethiopian parliament, Tuesday approved a new Property Tax Proclamation, introducing a landmark tax policy that imposes levies on urban land, buildings, and land improvements.

The law, initially introduced in June 2024, was part of a broader government effort to expand the tax base, including proposed amendments to value-added tax (VAT) and excise tax laws.

After undergoing scrutiny by the Standing Committee on Planning, Budget, and Finance Affairs, and following public consultations held in December 2024, the final version of the bill was passed with ten votes in favor and four against during Parliament’s 15th regular session.

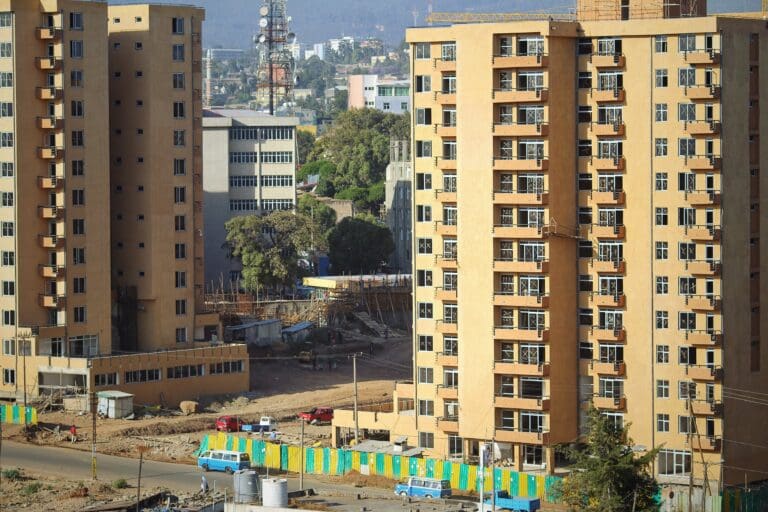

The law is set to bolster municipal revenue and finance infrastructure development, but it has also sparked heated debate regarding its potential impact on taxpayers and economic inequality.

Under the newly approved Property Tax Proclamation, the taxable amount for any property is set at 25% of either its market value or its replacement value.

The tax rate for land usage rights ranges from 0.2% to 1% of the annual taxable amount, while the tax on buildings and land improvements is set between 0.1% and 1% of their taxable value.

Municipalities are now authorized to collect revenue directly through property taxes, granting them increased financial autonomy to fund essential services and urban development projects.

MG/as/APA