The Monetary Policy Committee of the Central Bank of Nigeria (CBN) has raised the benchmark interest rate from 15.5 percent to 16.5 percent in order to check rising inflation and maintain economic stability.

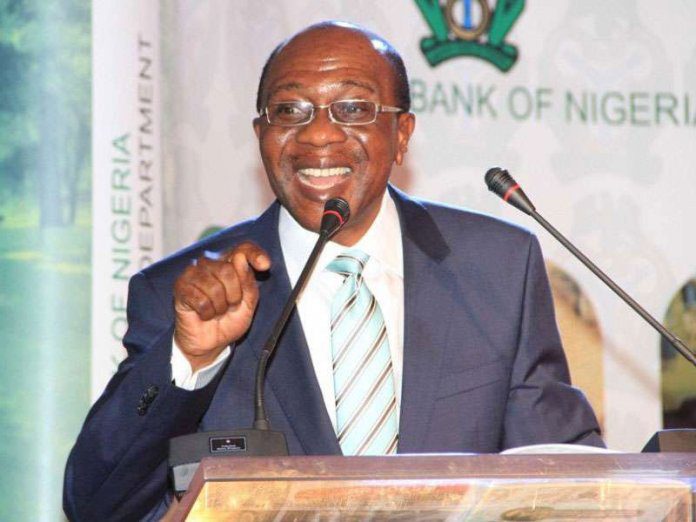

The Governor of the CBN, Mr. Godwin Emefiele, told journalists after the two-day Monetary Policy Committee (MPC) meeting on Tuesday in Abuja, that the committee voted to raise the rate to 16.5 percent, while retaining the asymmetric corridor of +100/-700 basis points around the benchmark interest rate, also known as the monetary policy rate.

He explained that the committee also voted to retain the cash reserve ratio at 32.5 percent and the liquidity ratio at 30 percent.

This is the fourth time the committee would be raising the benchmark interest rate since May when the rate was moved upwards from 11.5 to 13 per cent. The rate has since increased to 14 per cent in July, 15.5 per cent in September, and to 16.5 per cent in November.

Meanwhile, the CBN has projected that the Nigerian economy is expected to remain on the path of sustained positive growth.

According to the communique issued after the MPC meeting, the projection was based on the expected strong performance in the fourth quarter of 2022 and steady rebound in economic activities.

It will be recalled that the data from the National Bureau of Statistics (NBS) showed that the Nigerian economy has sustained positive output growth for seven consecutive quarters, following the exit from recession in 2020.

It attributed this growth largely to the growth in the non-oil sector.

“The consistent positive performance recorded was driven largely by the positive growth in the non-oil sector, particularly in the services and agricultural sub-sectors, complemented by continued policy support by the Bank,” the CBN said.

According to the NBS, the Real Gross Domestic Product (GDP) grew by 3.54 percent (year-on-year) in the second quarter of 2022 and 5.01 percent in the corresponding period of 2021.

The Nigerian apex bank also expressed concern at the persisting uptick in inflation for the ninth consecutive month with headline inflation (year-on-year) rising to 21.09 percent in October from 20.77 percent in September, causing an increase of 0.32 percentage point.

The CBN blamed the inflationary trend to the persisting uptrend in energy prices and the prolonged period of scarcity of petrol, which have contributed to a sharp rise in transportation, logistics and manufacturing costs, which fed through to consumer prices.

It added that other contributory factors include the protracted insecurity across the country; perennial flooding in major food producing states; critical deficit of infrastructure in the country and poor road networks amongst others.

GIK/APA