Economy, Planning and Cooperation Minister Abdourahmane Sarr says Islamic finance is more than just a financial solution as it represents a strategic vision to build a modern, competitive and inclusive Senegal by 2050.

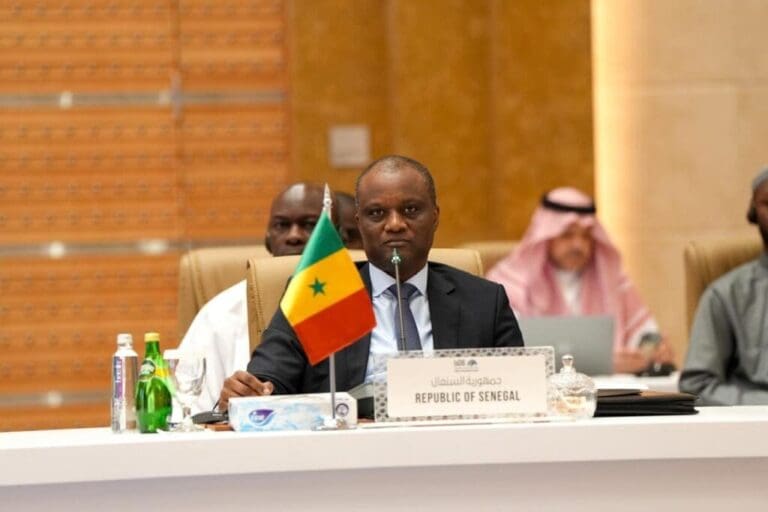

In a global context where conventional economic models face significant challenges, Sarr highlighted the potential of Islamic finance during a strategic retreat of the Islamic Development Bank (IDB) governors held in Medina, Saudi Arabia, on January 12.

This approach, he explained, aligns perfectly with the economic ambitions of Senegal’s Vision 2050 and offered tailored solutions to the country’s challenges.

Islamic finance, characterized by its innovative and solidarity-based principles, is seen as a strategic lever capable of driving Senegal’s transformation into a diversified, resilient and emerging economy.

Built on principles of social justice, partnership and shared responsibility, this financial system aligns with the long-term objectives of Vision 2050, aiming to position Senegal among Africa’s most competitive economies.

One of Senegal’s main challenges – shared by many African nations – is the saturation of sovereign debt and dependence on external financing.

Islamic finance, through innovative instruments like sukuk (Islamic bonds) and asset-structured financing mechanisms, offers an effective alternative for raising local funds while alleviating pressure on public finances.

Supporting SMEs and Urbanization

Small and medium-sized enterprises (SMEs), the backbone of Senegal’s economy, can benefit significantly from Islamic finance products, Sarr said.

These tools, based on risk-sharing, direct investment and asset financing, offer SMEs greater access to funding.

Additionally, as Senegal experiences rapid urbanization, the demand for urban infrastructure is growing. Islamic financial instruments like sukuk can help finance these projects without over-reliance on foreign loans.

These tools support Vision 2050’s goal of creating modern, sustainable and well-connected cities while preserving the country’s financial autonomy.

Sarr emphasized that Islamic finance embodies values of solidarity and economic justice, ensuring equitable resource distribution and supporting projects that include vulnerable populations.

“By relying on socially responsible financing mechanisms, Islamic finance aligns with the principles of Vision 2050,” he noted, stressing its potential to drive systemic transformation in Senegal.

Combined with transparent resource management and rigorous governance, Islamic finance is poised to become a key driver of innovation, entrepreneurship, and sustainability in Senegal.

It will not only finance infrastructure but also enhance the competitiveness of Senegalese industries, boost exports, and create jobs.

ARD/te/lb/jn/APA